The UAE’s national carriers are expanding their destinations, driven by the country’s strong global tourism and business reputation and the resurgence in travel demand. The General Civil Aviation Authority (GCAA) projects passenger traffic to reach 140 million, reflecting the ongoing growth and competitiveness of UAE airlines.

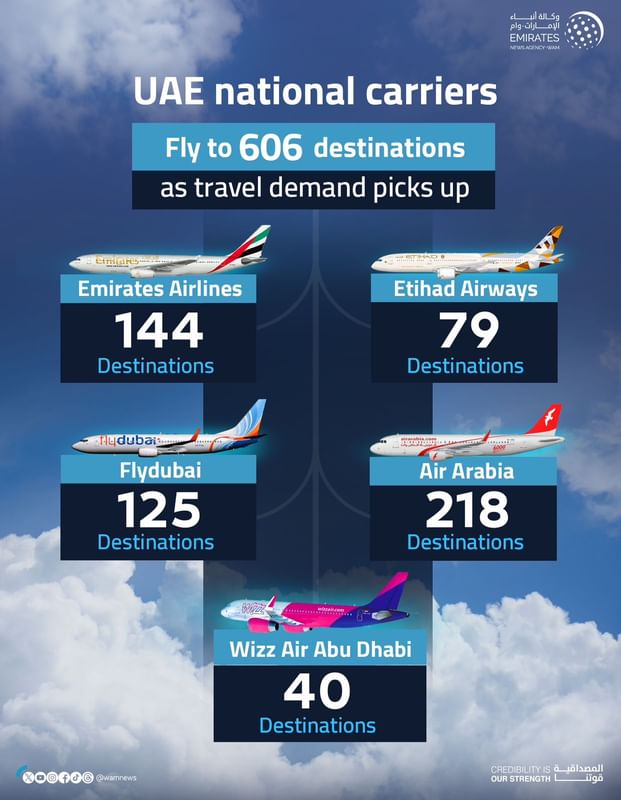

Official data indicates that UAE national carriers now serve approximately 606 destinations worldwide, including joint and cargo routes, marking a 3.4 percent increase from the 586 destinations served at the end of 2023. The breakdown of destinations by carrier is as follows: Emirates with over 144 destinations, Etihad Airways with 79 destinations, flydubai with 125 destinations, Air Arabia with 218 destinations, and Wizz Air Abu Dhabi with 40 destinations.

Etihad Airways, in particular, has been expanding its route network with the goal of reaching 125 destinations by 2030. The airline aims to leverage its strategic location between Asia and Europe and increase its annual passenger count to 33 million.

Etihad Airways has been strengthening its network since the beginning of this year, with plans to expand to over 125 destinations by 2030. This expansion strategy leverages its strategic location between Asia and Europe, aiming to increase its annual passenger count to over 33 million. The airline expects to introduce several new destinations this year after launching 15 new routes last year, including Lisbon, Copenhagen, Calcutta, and Osaka. Additionally, Etihad will increase its flights to Thailand to 41 per week starting in October and will resume flights to Nairobi on 15th December.

In the first seven months of 2024, Etihad Airways carried 10.4 million passengers and expanded its fleet to 93 aircraft by the end of July, compared to 78 aircraft in July 2023. The airline also added 10 new destinations to its network this year. In the first half of 2024, Etihad recorded a net profit after tax of AED 851 million, a 48 percent year-on-year increase, with revenues growing by 21 percent to AED 11.7 billion.

Emirates currently operates a network covering 144 passenger and cargo destinations across six continents, continually working to increase seat capacity to meet rising travel demand and provide flexibility and choice for travellers passing through Dubai.

Emirates Airlines

Emirates Airlines is set to fly its upgraded Boeing 777 aircraft to Zurich and Riyadh in early October and will add the same aircraft to its operations in Geneva and Brussels. Emirates is completing the modernisation of 80 more Boeing 777 aircraft as part of its more than US$3 billion programme to deliver the best products and services in the industry and elevate the passenger experience in the skies to unprecedented levels.

flydubai

flydubai flies to 125 destinations in 58 countries across Africa, Central Asia, Central and South East Europe, the GCC, the Middle East, the Indian Subcontinent and South East Asia, served by a fleet of 88 Boeing 737 aircraft.

flydubai recently launched regular flights to EuroAirport Basel Mulhouse Freiburg, four times a week, becoming the first national airline to operate direct flights from Dubai to this destination, growing its network in Europe to 29 destinations, including Budapest, Catania, Krakow, Milan-Bergamo, Prague, Salzburg and Zagreb.

The airline expects to take delivery of seven aircraft by the end of the year and plans to hire more than 130 new pilots to support its network expansion, adding Basel, Riga, Tallinn and Vilnius to its destinations.

Air Arabia

Air Arabia Group operates an extensive network with 218 destinations across six strategic hubs, including 113 from the UAE, as well as locations in Morocco, Egypt, and Pakistan. In the first half of 2024, the airline reported a net profit of AED 693 million and served 8.9 million passengers, marking a 16 percent increase from the previous year. The seat occupancy rate remained strong at 81 percent.

Wizz Air Abu Dhabi

Wizz Air Abu Dhabi has a portfolio of 40 destinations and continues to expand its operations to meet growing demand with a modern and sustainable fleet, supporting the airline’s ambitious plans to launch flights to new destinations.

World3 years ago

World3 years ago

World3 years ago

World3 years ago

Business12 months ago

Business12 months ago

Entertainment7 years ago

Entertainment7 years ago

World7 years ago

World7 years ago

Entertainment7 years ago

Entertainment7 years ago