Business

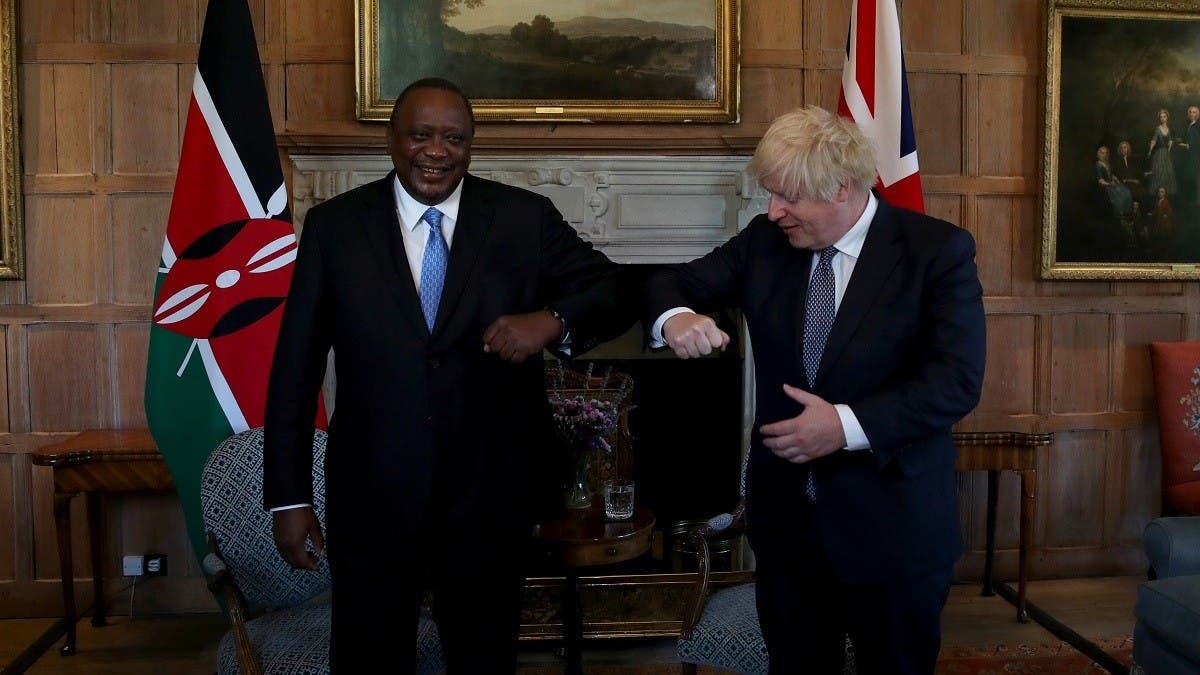

Britain steps up Kenya investments with railway hub, eyes $1 bln deals

-

World2 years ago

World2 years agoComprehensive plan for development of Arab culture to be discussed at UAE conference

-

Entertainment1 year ago

R-rated Winnie-the-Pooh movie brings scary spin to Disney’s beloved character

-

World2 years ago

World2 years agoHead of new Yemeni council promises end to war via peace process

-

Entertainment7 years ago

Entertainment7 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

World7 years ago

World7 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment7 years ago

Entertainment7 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

World1 year ago

At least 53 dead in Turkey after 7.8-magnitude earthquake: Officials

-

Emirates2 years ago

S. Korea reports 93,135 new COVID-19 cases